Financial risk industry executives offer students advice and perspective

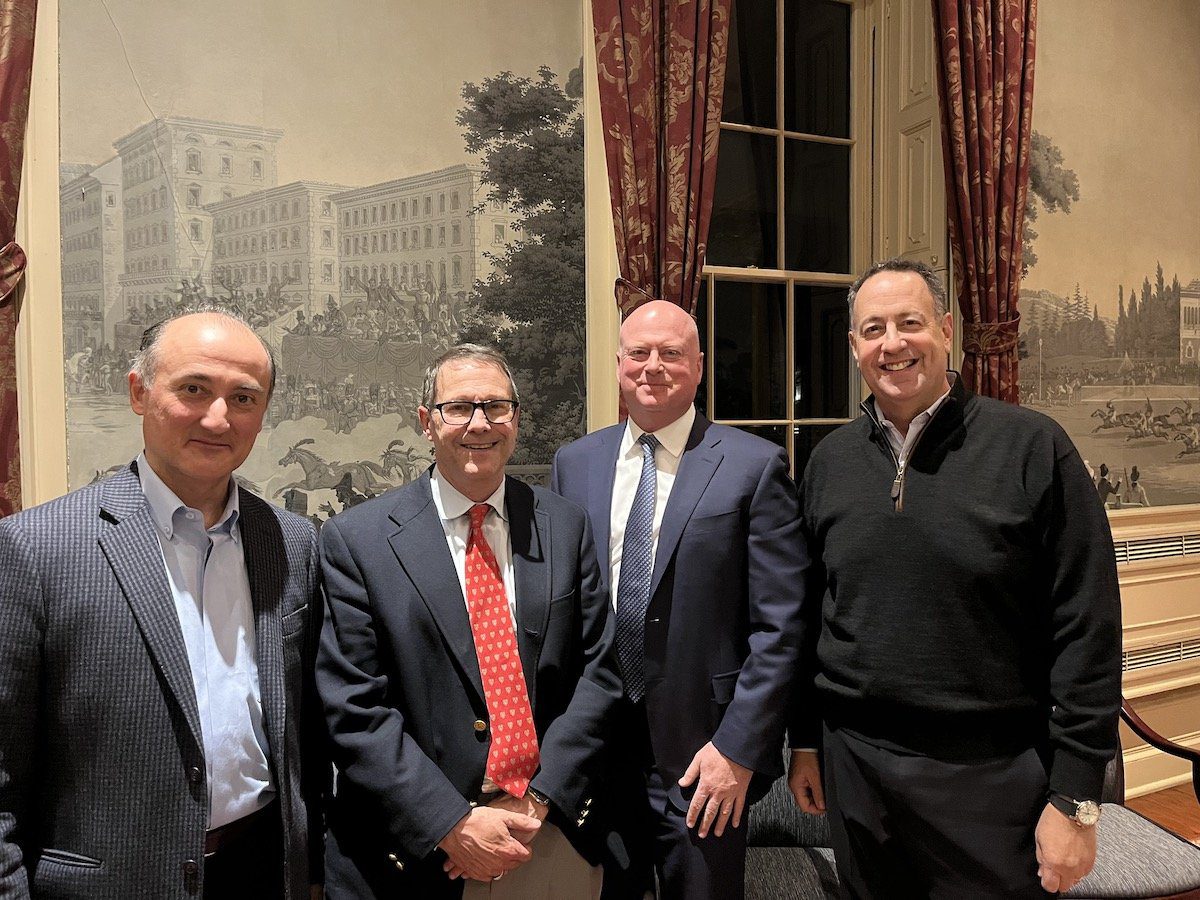

November 2022 – Drew University’s Caspersen School of Graduate Studies hosted its second annual Chief Risk Officer Summit roundtable discussion for students in the Master of Science in Finance (MFin) program, as well as undergraduate students interested or majoring in finance, business, and economics.

The roundtable featured Ken Abbott, distinguished lecturer at Baruch College’s Zicklin School of Business and former chief risk officer at Barclays Bank; Jason Hickey, global markets risk executive at Bank of America; and Gary Mandelblatt, managing partner at NextGen Strategic Partners and former chief risk officer at Nomura Americas.

The discussion was organized and moderated by Kerem Yaman, adjunct professor of finance and chief operating officer of global markets risk management at Morgan Stanley, and Steve Firestone, director of Drew’s MFin program.

The industry leaders provided in-depth and candid insights into the process of running a large risk organization and the key risks present in today’s market.

With a volatile market and economic uncertainty, risk management plays a critical role. “This is why we bring these chief risk officers to campus to discuss market, credit, and operational risks,” said Firestone. “They see the full field of the markets better than others and have been elevated to top positions within large U.S. banks. Students can benefit tremendously from that expertise to chart their own paths.”

Yaman asked the group if they believe the U.S. is headed towards a recession; the general consensus was that a traditional recession was very possible—even likely. However, a severe recession, as we saw in both 1981 and 2008, seemed unlikely to most panelists.

There are many factors that can further enhance the U.S. financial market volatility, including rising interest rates, commodity availability, and global political unrest. “You don’t know from one day to the next what is going to happen,” said Hickey.

The group was not surprised by the devaluation of cryptocurrency and bitcoin, stating that the products were not designed to exist in a regulated environment.

“Risk is always there,” said Mandelblatt. “What you don’t know is how it’s going to come out.”

Ken Abbott echoed the sentiment of others about cryptocurrencies, but was more optimistic about the future of blockchain technology and central bank digital currencies.

The group advised the students to consider gaining front office experience as it’s hard to be effective in a risk management role in a large institution without it. “Managing a group of people is like conducting an orchestra,” said Mandelblatt. “The hardest part is getting people to think differently.” That includes being able to think like a trader or other front office person when assessing risk in an investment bank.

A Q&A session with the students followed the roundtable discussion.