Tax Information

Here is some helpful information for you to know when filing taxes in the U.S. For detailed information, please go to the IRS website, where you will find information available also in Chinese, Korean, Russian and Vietnamese.

U.S. Income Tax System

- It’s the individual’s responsibility to file tax forms based on information that was presented to the employer on Form W-4

- The employer withholds earnings which are an estimate of your federal and state tax liability

- Employees file tax forms in the spring of each year which covers the previous tax year (Spring 2020, file for 2019 tax year)

- You may be issued a tax refund if you’ve overpaid taxes or you might owe money to the IRS

Residency Status for Tax Purposes

Nonresident Alien

- Is Not a U.S. citizen or permanent resident (green card holder)

- Is an individual in the U.S. on a nonimmigrant visa who has not passed the Substantial Presence Test

- Is subject to special tax rules: credits/deductions limited; only U.S. sourced income taxed; tax treaties

Resident Alien

- Is a student (F or J visa) who has been in the U.S. longer than five calendar years AND passes the Substantial Presence Test

- Has worldwide income taxed in the same manner as U.S. citizen

Form 8233 Tax Treaty

- Submit Form 8233 to the Payroll Office ([email protected]) by December 15th EACH YEAR

- Payroll sends an email to students in November with reminder

- Form 8233 information determines if a W-2 or 1042s is generated

Documents Needed to File Tax Forms

- Passport

- Visa

- Form I-94 – U.S. entry/exit dates

- A Taxpayer ID Number

- Social Security number

- Individual Taxpayer Identification Number (ITIN)

- Child’s SSN to claim credit (Canada, Mexico, India, or S. Korea)

- Last year’s federal and state returns (if you filed them)

- W-2 – Wage and Tax Statement

- 1042s – Foreign Person’s U.S. Source Income Subject to Withholding

- Form 1099-INT (interest & dividends)

Form 8843

Filing Information

All non-residents (and F-2 dependents) must file this if they were in the U.S. during the tax year.

Filing Date:

- If no income earned in 2019 – June 15, 2020

- If income is earned in 2019 – April 15, 2020

Mailing Instructions

IF you are ALSO required to complete a 1040NR or 1040NR-EZ (because you had U.S. income), mail your forms together to the address provided for your 1040NR or 1040NR-EZ. You can use Sprintax for help.

IF you are NOT required to complete a 1040NR or 1040NR-EZ, mail your 8843 to:

Department of the Treasury

IRS Service Center

Austin, TX 73301-0215

W-2 and 1042s

- Hard copy of the 2019 W-2’s are in the Payroll office, Madison House (ID required). Electronic copy available in ADP.

- The 2019 1042s will be finalized by mid-March. Payroll will send an email to students to advise when the they are ready.

- Login to ADP to view pay statement per payday to check earnings, taxes and deductions. Any discrepancies should be brought to Payroll’s attention.

- Payroll wants everyone to sign up for direct deposit in ADP.

- You might receive a W-2 (wages w/no tax treaty) & 1042-S (scholarship payments)

Form 1040NR EZ

- Form 1040NR-EZ: https://www.irs.gov/pub/irs-pdf/f1040nr.pdf

- Form Instructions: https://www.irs.gov/pub/irs-pdf/i1040nr.pdf

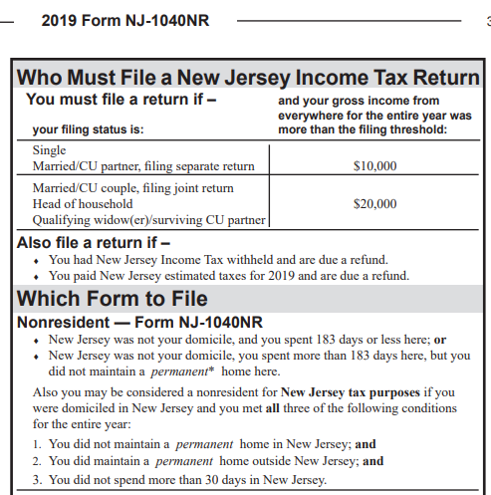

New Jersey Form 1040NR

Resources

- Sprintax: Nonresident tax prep software

- The cost to prepare the federal income tax is $37.95 and State tax from $29.95.

Link: https://www.sprintax.com/?utm_ref=drew-university&utm_content=prmc

- The cost to prepare the federal income tax is $37.95 and State tax from $29.95.

- Tax Treaties: https://www.irs.gov/pub/irs-pdf/p901.pdf

- Publication 519: US Tax Guide for Aliens

https://www.irs.gov/pub/irs-pdf/p519.pdf - VITA volunteers:

https://www.irs.gov/individuals/free-tax-return-preparation-for-you-by-volunteers - Foreign Students and Scholars:

https://www.irs.gov/individuals/international-taxpayers/foreign-students-and-scholars

Frequently Asked Questions (FAQs)

How do I check on Refund Status?

Go to this link for your refund status: https://sa.www4.irs.gov/irfof/lang/en/irfofgetstatus.jsp

What if I never received a W-2 from my employer?

It’s your responsibility to contact your employer – not an excuse to avoid filing (they may not have your address). IRS can assist if required https://www.irs.gov/taxtopics/tc154

I earned bank interest, is that income earned?

No. Bank interest and interest on CD’s are not considered earned income for non-resident aliens, and thus not reportable

Should I keep copies of my tax returns?

Yes, keep copies of all documents. The IRS can audit for up to 3 years.

What do I do if I forgot to file taxes one year?

You are allowed to file tax returns for previous tax years. Info and forms are available at

https://www.irs.gov/newsroom/help-yourself-by-filing-past-due-tax-returns